You may have already heard that Single Touch Payroll (STP) is mandatory for all businesses that have payroll (including directors) from the 1st of July 2019.

This article provides an overview of what STP is, how it applies to your business, and what Think Big Financial Group is doing to set this up and support you with STP going forward.

What is Single Touch Payroll (STP)?

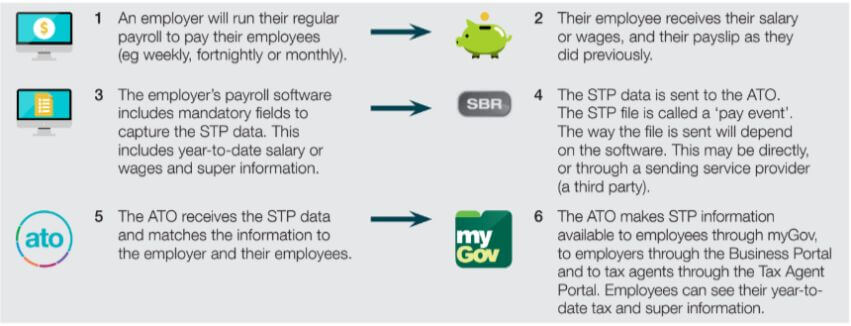

STP is a reporting change from the ATO that enables employers to send tax and super information to the ATO from their payroll software each time they pay their employees.

Instead of the ATO only receiving payroll information when an IAS or BAS is submitted, or at year-end when payment summaries are lodged, they will now receive this information when each pay is run and finalised.

You can find further information here: https://www.ato.gov.au/Business/Single-Touch-Payroll/About-Single-Touch-Payroll/.

How does STP work?

Single Touch Payroll infographic, courtesy of ATO.gov.au

What needs to happen now?

If Think Big Financial Group is processing your payroll, the next steps are very simple and quick. A team member will be in contact with an authorisation form, will set this up in your accounting system, and will let you know what needs to happen (if anything) from your end.

If you are processing your own payroll and Think Big Financial Group is processing your IAS/BAS, then the above will also apply to you.

If you are currently processing your own payroll and IAS/BAS, then now might be a great time to get in contact with one of our team for some additional support to ensure your payroll system is setup correctly to manage this change.