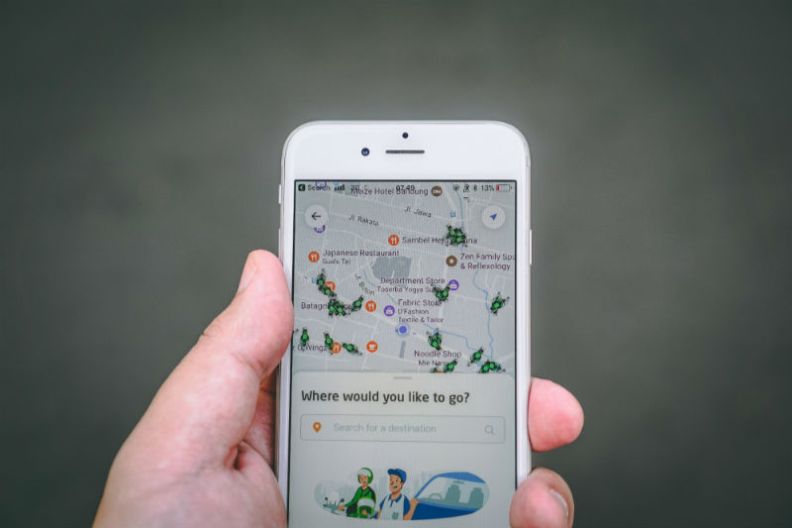

Uber connects riders with drivers through apps…

Airbnb connects hosts with travellers looking for a place to sleep through its website…

Zopa connects lenders with borrowers through its peer-to-peer lending service…

Many people are unlocking the value of their underutilised resources by sharing them with others in exchange for a benefit – both monetary and otherwise. This new way to income has become known as the ‘sharing economy.’ And, with help from the internet, this new business model is quietly turning ‘average Joes’ into successful entrepreneurs.

A broad variety of services is encompassed by the sharing economy where you can earn extra cash by:

- renting out space in your garage, a spare room, or your car

- car-pooling

- acting as a personal tour guide

- running errands or completing chores for people who are time-poor

- you can even trade your clothes or play swapsies with your house.

The opportunities are endless.

The sharing economy does not simply match supply and demand as traditional economic theory does. Instead, it includes the renting, sharing, and collaborative consumption of underused assets. And, it involves an element of trust.

These are exciting times! This new ‘economy’ is gaining momentum across the world. New, innovative sharing businesses are constantly emerging. Some work, some don’t.

As with any new venture, always seek professional advice first.

If you are thinking about taking part in the sharing economy, take a moment to consider the risks involved first. There are many grey areas because the model is still in its infancy. This is especially true in relation to regulatory requirements and insurance.

A confusing area for some is how this is taxed. Although the sharing economy may be thought of as an unconventional system, it is still viewed by the Australian Tax Office (ATO) in the same way as a traditional economic system.

Tax implications

Tax law applies to the sharing economy the same way it would apply in a conventional economy. If you earn income from renting out a bedroom or running errands, the ATO will expect you to keep records of any income received along with any allowable deductions to include in your tax return.

What about GST?

If you generate an annual turnover of $75,000 with your sharing services, you are required to register your business for GST. Remember that this also includes income from any other enterprise activity that you might be involved in (however, it does not include any rental income you receive from a residential property).

Note, however, that if you are providing a ‘taxi service’ of some kind, you need to register for GST regardless of your level of income. This includes any service where you drive passengers in a vehicle in exchange for a fee. The ATO has more details on its website.

For individual guidance on how to structure your business setup to take advantage of this financial opportunity, book in for a chat with a Think Big advisor today.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Speak with a tax accounting specialist (such as TBFG) who is up-to-date with applicable deductions, tax law, and business structuring to get you the biggest return on your EOFY tax assessment.