Current ATO focus areas (3 main points): Work related expenses (WRE). Rental properties. Crypto/digital assets. WRE – mistakes often made: Copy/paste deductions from last year – big ATO target area...

Client ID verification requirements The Australian Taxation Office (ATO) and the Tax Practitioners Board (TPB) have introduced new client ID verification rules. All Tax and BAS agents are now required...

Your credit score or rating is used by lenders to get a better understanding of any risk they may face when choosing to give you credit or lend you money....

Imagine that, without any effort on your part, enough money regularly pours into your bank account to meet (or exceed) all your living expenses. Suddenly, work becomes optional and a...

James was twenty-something and eager for adventure when he spotted the advertisement. It read, “Japanese schools seeking English teachers. No experience necessary – we train you.” What followed changed James’s life...

Move over debit and credit cards; consumers are flocking to Buy Now Pay Later (BNPL) services Afterpay, Zip Pay, and several similar payment solutions allow shoppers to take home their...

Australian retirees are currently facing a ‘double whammy’ when it comes to funding their retirement. Consequently, if you plan to retire at 65 it requires some strategy to keep your...

Can you use equity to build wealth? The equity in your home is simply the difference between the current market value of your home and the amount you still owe...

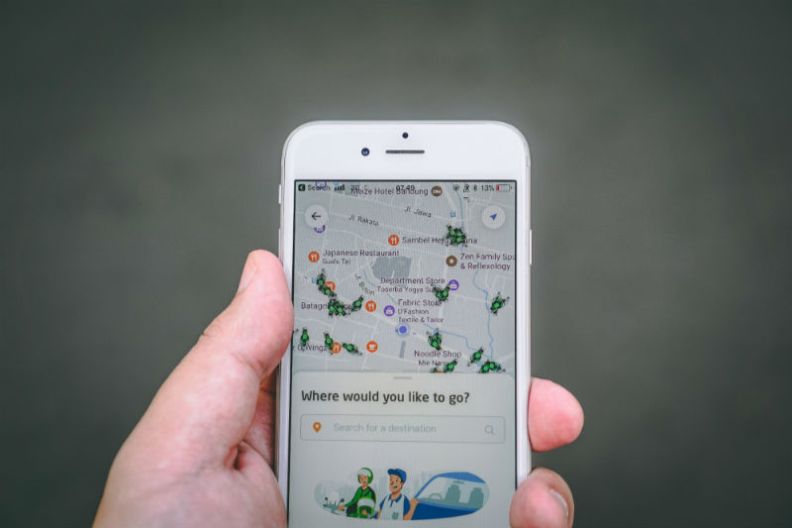

Uber connects riders with drivers through apps... Airbnb connects hosts with travellers looking for a place to sleep through its website... Zopa connects lenders with borrowers through its peer-to-peer lending...

Do you think of your home loan as set-and-forget? Riding out whatever the original loan terms and prevailing interest rates dish up along the way? You may be doing yourself...

Personal insurances such as life insurance provide protection from the financial consequences of death or disability. They are, therefore, an important part of most financial plans. When we work with...

Do you find the ins and outs of superannuation confusing? If so, check out these answers to frequently asked questions about super to get a handle on the basics. How...